In Which Case Can We Not Use a Dcf Valuation

Stock based compensation in the DCF. Thanks for also sharing my website which helps my content beeing available to more users worldwide 5 thoughts on Small Cap Premium for.

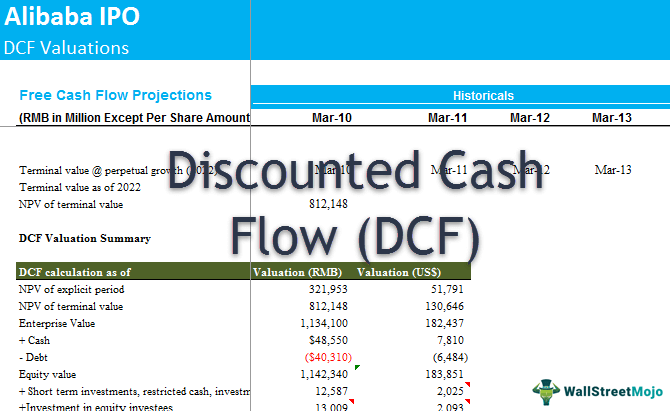

The Discounted Cash Flow Dcf Valuation Method Magnimetrics

Of these three potential distortions in the DCF the SBC is the least understood when we run analyst training programs.

. Growth Rate cannot be greater than WACC. In our examples we used the free cash flow but feel free to use Buffetts owner earnings or you can use earnings as well. You can read more regarding DCF Valuation.

Building a financial model with detailed financial projections can be quite time-consuming. In this case none of the three approaches will work. We assume that the company will sell off all its assets at the end of year ten at a Sell off valuation.

In this article we will explain the. We therefore offer a platform for a wide range of industry-specific financial forecasting model templates in Excel which not only offers a good structure but also the best in class financial modeling know-how to users such as key executives entrepreneurs investors and many more. If such is the case then you cannot apply the Perpetuity Growth Method to calculate Terminal Value.

Thanks and have a great day. However when it comes to broad classification there are really only two types of approaches possible. This implies that you cannot apply a Discounted Cash Flow approach.

Perhaps they are looking for country specific premiums that you already have. Another bonus to using the DCF valuation is you are touching many different parts of the financials of a company the sales costs debt equity free cash which forces you to have a good pulse of the financials of any company. Well use a multiplier of 12 for the tenth year cash flow to simulate the value of these cash flows in the case company would sell all its assets This is a necessary assumption that we need to make in order to find the value of the.

Of course each type of models has their own subtypes. The only way to value such a firm will be to use Relative valuation multiples. Real estate appraisal property valuation or land valuation is the process of developing an opinion of value for real property usually market valueReal estate transactions often require appraisals because they occur infrequently and every property is unique especially their condition a key factor in valuation unlike corporate stocks which are traded daily and are identical thus a.

Please comment below and we can help people who are looking for the correct small cap premiums for their models. Equity valuation can be conducted using two broad types of models. One of them is called the absolute valuation approach whereas the other is called the relative valuation approach.

In the SeekingAlpha post the author asserted that SBC represents a true cost to existing equity owners but is usually not fully reflected in the DCF.

Build A Dcf Valuation Model Online Courses With Certificates Udemy Coupon Online Teaching

Example 2 5 Skill Training Cost Of Capital Learning

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

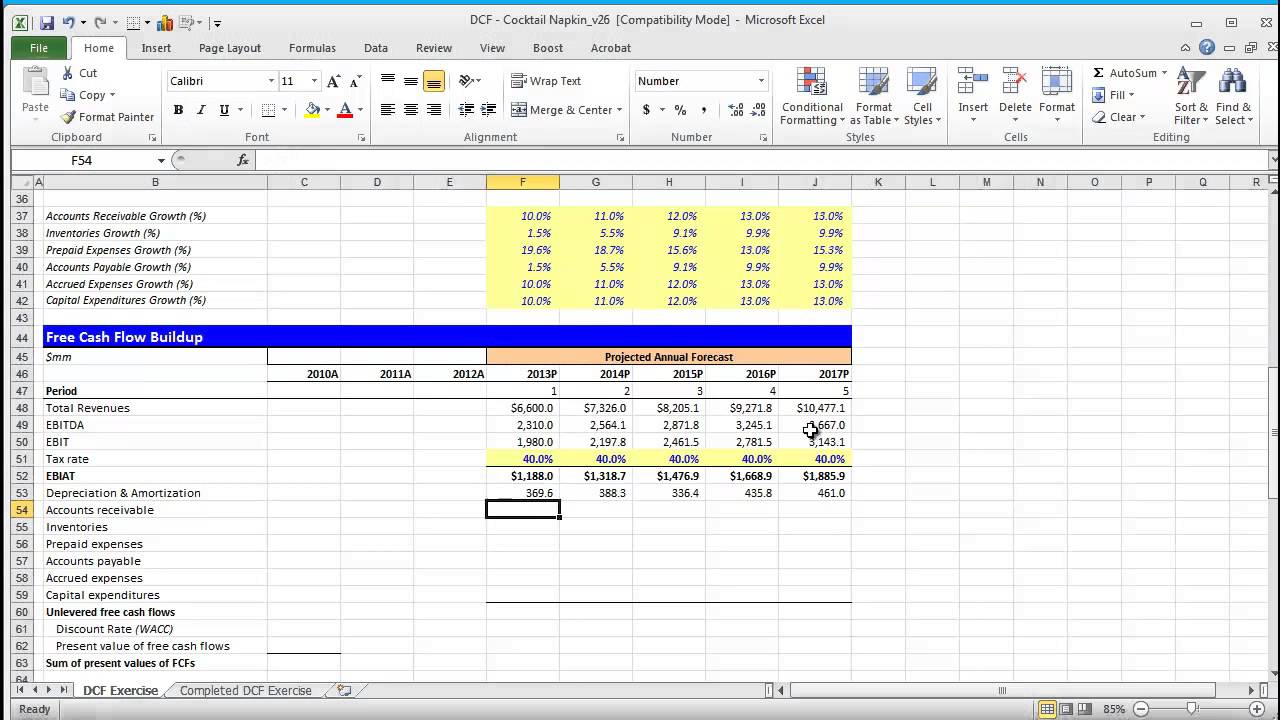

Financial Modeling Quick Lesson Building A Discounted Cash Flow Dcf Model Part 1 Financial Modeling Cash Flow Financial

/dotdash_Final_Top_3_Pitfalls_Of_Discounted_Cash_Flow_Analysis_Feb_2020-01-a5c2306a3b294872a505aa63bd2cea7e.jpg)

Top 3 Pitfalls Of Discounted Cash Flow Analysis

The Golden Guide To Valuation Case Study Finance Books Financial Analyst

How To Calculate Your Company S Valuation Discounted Cash Flow Dcf Method

Amazon Com Damodaran On Valuation Security Analysis For Investment And Corporate Finance 9780471751212 Aswath Damodaran Books Finance Books Finance Investing

The Discounted Cash Flow Dcf Valuation Method Magnimetrics

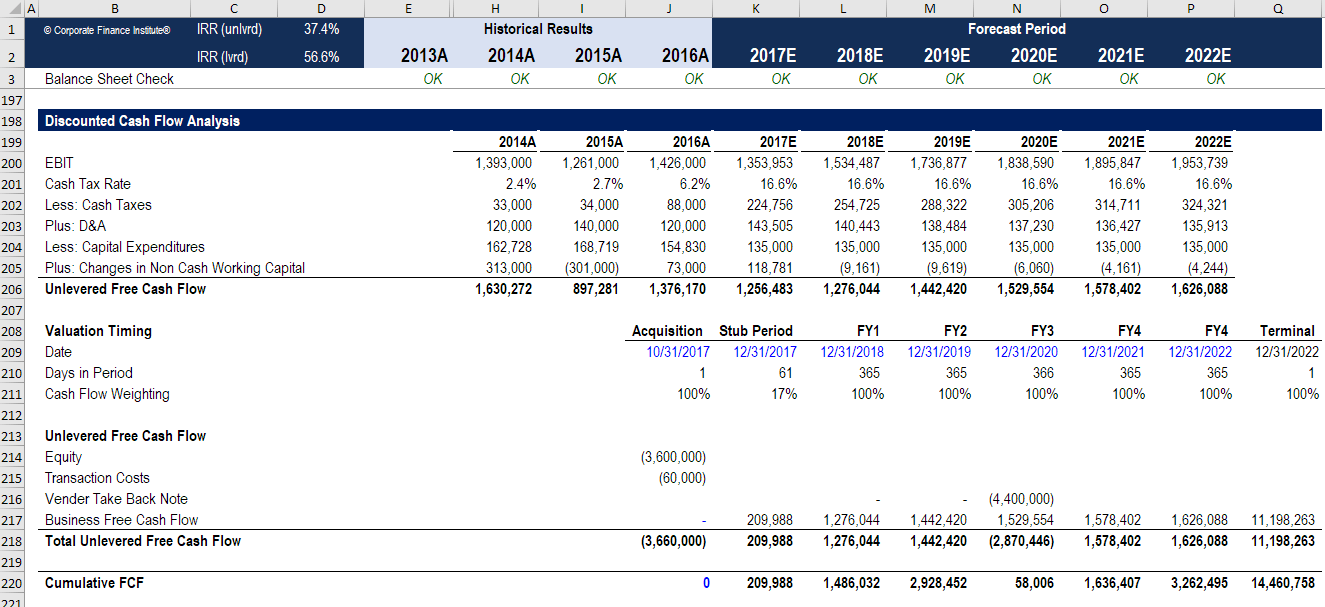

Dcf Analysis Pros Cons Most Important Tradeoffs In Dcf Models

How To Use Discounted Cash Flow Time Value Of Money Concepts Money Concepts Time Value Of Money Cash Flow

How To Create A Geographical Map Chart In Microsoft Excel Microsoft Excel Microsoft Map

Stock Valuation Flow Chart The Free Investors Flow Chart My World Of Work Process Flow

:max_bytes(150000):strip_icc()/DiscountedCashFlowsvs.Comparables2-fea4624dffab4bd8bec311cb6d134a2f.png)

Discounted Cash Flows Vs Comparables

Bank Valuation Demystified Case Study Financial Analyst Practice

Comments

Post a Comment